Table of Contents

What is Mobile Banking?

Mobile banking is becoming increasingly popular, especially among millennia’s. They are more likely to use their smartphones for online transactions than anything else. The bank of America predicts that more than half of smartphone users will use their device to make an online purchase this year and for many millennia’s rely primarily on their phones for financial transactions. Mobile payments and mobile banking is expected to grow even faster in 2021 as consumers wait less time in line at brick-and-mortar stores and find it easier to make purchases over the phone.

How Does Mobile Banking Work?

Mobile Banking is the act of accessing your bank account through your mobile device. It is an act of logging onto your bank account to check balances, transfer money, pay bills, and deposit checks.

It allows you to remain connected with your finances from anywhere you have internet access on your mobile device. This includes whether you’re at home on the couch or on a business trip overseas.

Mobile banking can be a valuable tool for those who are constantly on the go and need a simple way to access their financial information.

It offers many conveniences such as being able to avoid long lines at the bank, being able to check balances without needing cash, and getting alerts about suspicious transactions if needed.

However, some people do not like it because they feel as though it causes them

Benefits of Banking Services:

Mobile banking is also known as “mobile money services“. Mobile banking is the act of using a mobile device to access one’s bank account. This can be done via an application or platform that offers mobile banking services, or through the use of text messages with bank commands.

This helps in many ways:

Convenience – A person can access their account anywhere and anytime because they do not need to visit a physical branch. They just need their phone, an internet connection and some security credentials to get started. Also, this is very beneficial for anyone who has difficulty visiting branches due to disability or other reasons. They can do all their banking activities from home without any hindrance.

Security – Banking data never leaves the secure boundaries of the software, which prevents

Mobile banking is becoming more popular with the increase in smartphone usage. Its convenience and ease of use are some reasons why many people use it.

It has become an integral part of our lives and we can’t imagine a world without mobile banking.

Mobile banking gives you more freedom to keep your banking information secure and to be able to access it anytime anywhere, which is a very valuable thing for those who travel often or work remotely.

It has also changed the way people do their transactions as it allows them to better manage their spending habits and track what they’re spending money on.

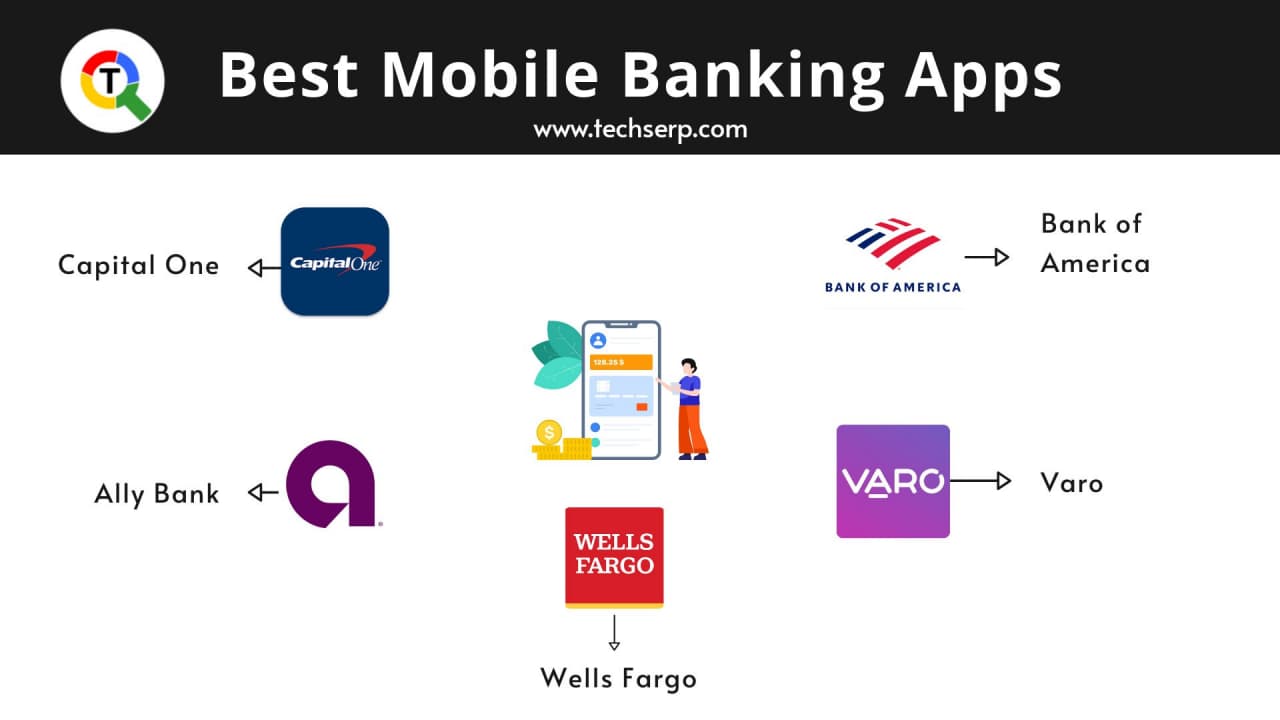

List of Best Mobile Banking Apps:

- Capital One

- Ally Bank

- Bank of America

- Varo

- Wells Fargo

Capital One:

Capital One is one of the United States’ largest financial services companies. The company offers planning, lending, saving, and protection products to consumers, small businesses, and commercial clients. Capital One can help you with your mortgage or other loans.

Visit: www.capitalone.com

Ally Bank:

Ally Bank is an online-only bank with no physical branches. The Ally Bank offers some of the best CD rates that are available in the United States. Ally is an FDIC-insured bank with access to more than 5,000 ATMs across the U.S., Canada, and Mexico.

Visit: www.ally.com

Bank of America:

Bank of America has long been the largest bank in the US. It was founded in 1904, and it is headquartered in Charlotte, North Carolina. The company offers a wide range of products for both consumers and businesses, including banking, credit cards, mortgages, loans & more.

Visit: www.bankofamerica.com

Varo:

Varo is a mobile banking app that provides convenience and security for its users. The Varo is available in the US and Canada and has zero fees for transactions. It offers users the ability to open up a bank account with them, transfer funds, get paid, pay bills in person or over the internet, deposit checks without taking them to the bank, have overdraft protection in case their account ever

Visit: www.varomoney.com

Wells Fargo:

Wells Fargo is a financial institution based in San Francisco, California. Founded in 1852 by Henry Wells and William Fargo, it provides banking, insurance, investments, mortgage loans, and consumer finance services. It is the fourth-largest bank in the United States.

Visit: www.wellsfargo.com

You may also read: CBS in Banking

Comments are closed, but trackbacks and pingbacks are open.