Large cap growth stocks generally comprise the top 100 listed Indian companies with a market capitalization of over ₹20,000 crore. These companies have strong financials, exhibit lower volatility on the exchange, and are renowned for offering regular dividends. Many of these stocks are growth stocks expected to increase in value faster than the broader market. The key question is: when growth stocks are in focus, what is the potential role of large-cap stocks, and where do they fit in? Let's discuss.How Do Large Cap Stocks Fit in as Growth Stocks?

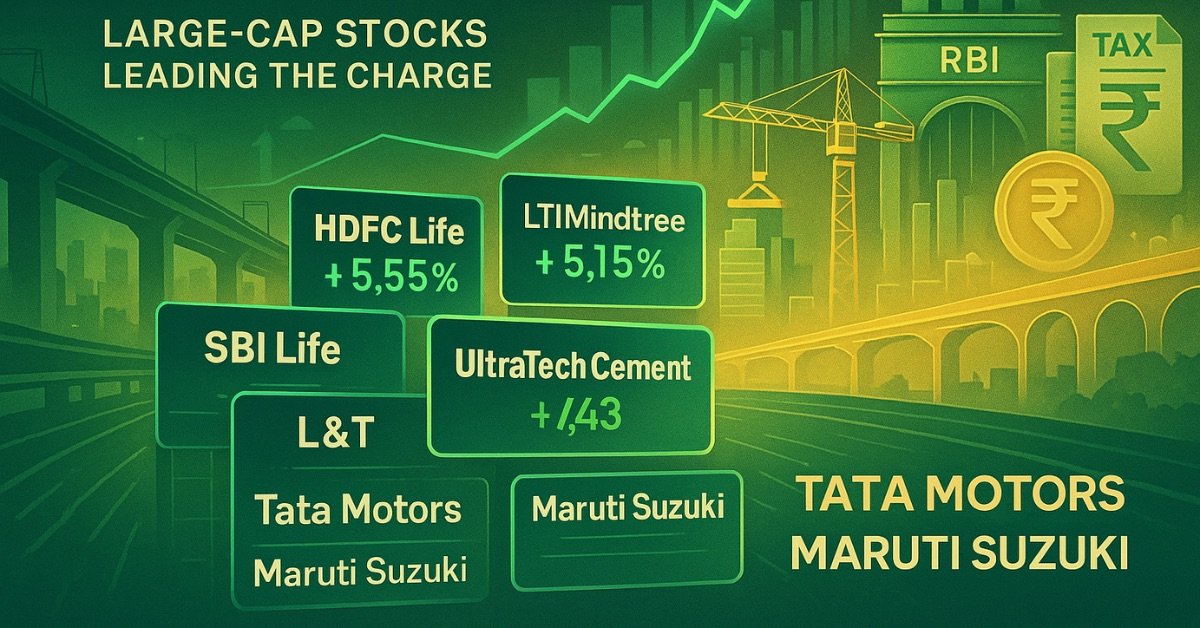

In recent months, amid uncertainty caused by the trade war, large-cap growth stocks have shown resilience, with several outperforming the broader market.

With a 5.17% upward movement in the Nifty 50 and a 5.71% rise in the Sensex over the past month, many stocks like HDFC Life stock (5.55% monthly return), LTIMindtree stock (5.15%), andAdani Ports stock (7.43%) have shown notable gains. Some of the factors that can help large-cap stocks become growth stocks are:

The government has recently increased the Foreign Direct Investment limit in the insurance sector from 74% to 100%. This step boosts insurance coverage across India and brings global standards to the insurance industry. Major companies such as SBI Life, HDFC Life, and ICICI Prudential Life will likely gain from this development.

In the budget, the government also announced an allocation of ₹10 lakh crore to improve infrastructure, especially highways. With development underway, companies like UltraTech Cement and L&T will likely benefit.

Companies like Dixon Technologies, which is involved in mobile manufacturing, will benefit in the long run from reduced import duties on components, which will help them increase domestic production.

Multiple macroeconomic factors also influence large-cap stocks. Data from 2022 provided by Burgundy Private Hurun India 500 shows that the top 10 companies in terms of valuation contribute $872 billion to the Indian economy, which is 37% of our GDP. Considering India’s position as the fastest-growing economy, with a predicted growth rate of 6.2% in 2025 and 6.3% in 2026, it is fair to say that some large-cap stocks have the potential to outperform the overall market.

The Reserve Bank of India recently announced a 25 basis point cut in the repo rate. When such rate cuts are announced, companies’ borrowing costs decrease. This enables them to expand into new locations, launch new products, and invest in research and development.

These actions benefit companies, whether large or small, by boosting their revenue and increasing profits, which ultimately raises their stock prices.

The announcement made in the Union Budget of 2025 has positively impacted not only MSMEs but also large-cap companies. For instance, raising the income tax exemption limit to ₹12 lakh can leave people with more money in hand, encouraging higher spending, which may positively impact FMCG companies such as HUL, ITC, Dabur, and Nestlé. It will also allow people to spend money on semi-essential needs such as home renovations, which may lead to paint company share prices like Berger or Asian Paint share price seeing positive changes.

The rise in disposable income is also expected to drive demand for hatchbacks and compact SUVs, thereby increasing Tata Motors and Maruti Suzuki’s revenue.

Several large-cap stocks are now on the growth radar. They offer stability and dividends while capitalising on growth opportunities. These stocks have further profit potential, supported by government policies, projected economic growth, and the recent cut in the repo rate. However, before investing, individual goals and risk tolerance levels should be considered.

Also Read:

The Ultimate Guide to Financial Freedom